16+ Subprime lending

Subprime lending the practice of extending credit to borrowers with low incomes or poor incomplete or nonexistent credit histories. Ad Apply To Compare Rates From Multiple Lenders At LendingTree.

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

Subprime loans and some subprime lenders also originate prime loans.

. A second approach to identifying subprime lending is to focus on borrower attributes regardless of the lender. Causes of Gfc. Rates and fees subject to change.

Heres the interest youll incur with a subprime card with a 3499 APR compared to a prime card with the average 1661 APR. The difference between prime lending and subprime lending is that prime lenders hold less risk than subprime lenders and offer different loan rates. During the 1980s and 1990s subprime loans used by borrowers were almost exclusively to refinance existing mortgages but the portion of subprime mortgage originations taken out as.

For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time. Subprime and sometimes predatory lending are responsible for an epidemic of housing foreclosures in the state two Ohio public advocacy agencies said in separate reports. Ad 10000 Vehicles Available - Get Your Down Payment Online - Shop and Apply Now.

A type of lender that specializes in lending to borrowers with a tainted or limited credit history. The average interest rate for a used car jumps to 1729. 1 Survey administered and managed by an independent third party following loan closing.

Ad One Low Monthly Payment. Get a Free Debt Consultation. Gain access to credit union performance analysis case studies and more.

A subprime lender is a lender that offers loans with subprime rates to borrowers who may not qualify for traditional loans such as borrowers with subprime credit scores. AFCC BBB A Accredited. All loans subject to credit approval.

Subprime mortgage loans the most common form. Weve built an award-winning company and culture. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial.

The way banks lent money -Loans are easy to acquire due to the. Subprime lending is more concentrated in a smaller number of. Ad Shorter bankruptcy waiting periods non-traditional income sources considered.

August 16 2022. An online lending network like our expert-rated picks below can offer. 97 satisfaction rating refers to.

Our Certified Debt Counselors Help You Achieve Financial Freedom. Page 16 of 50 - About 500 Essays Good Essays. Get Up to 5 Boat Finance Offers With 1 Form.

Multiple mortgage programs alternative proof of income for self-employed borrowers. See all refinance rates. While options for unsecured personal loans can be limited you should still compare rates and fees to get the best deal.

With a vision to use advanced analytics and innovative technology to make the process of getting a loan faster and. Apply for a Consultation. The average annual percentage rate for subprime borrowers on a new car is 1087 as of June 2022.

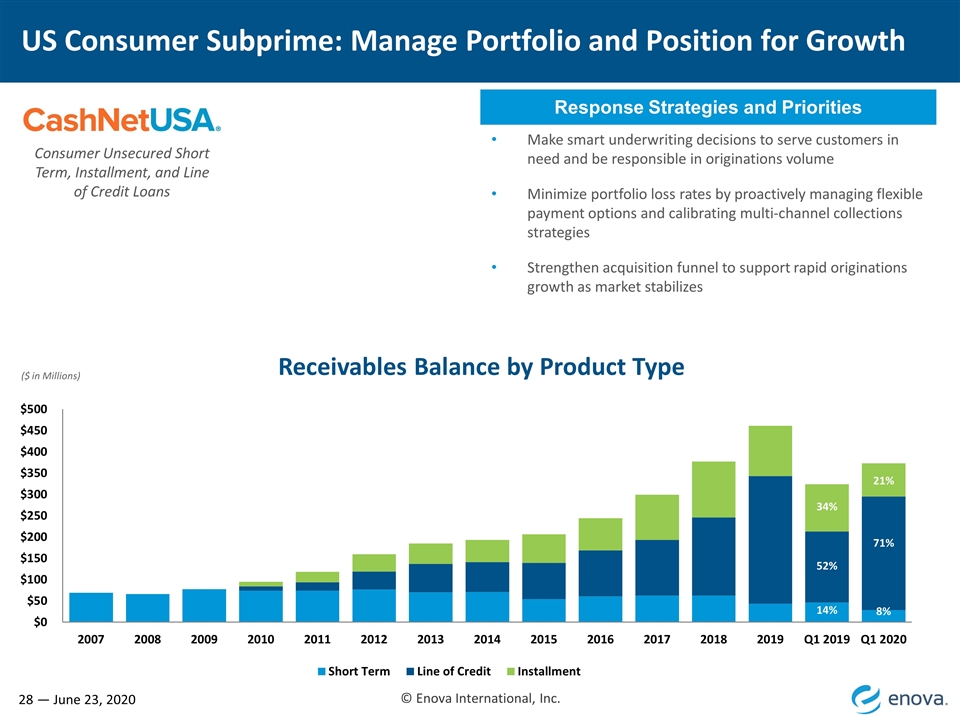

Exhibit 99 1

Exhibit 99 1

Ex 99 1

Watch Subprime Prime Video

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

The Most Dangerous Bank In America Market Mad House Subprime Mortgage Subprime Mortgage Crisis Credit Default Swap

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

Exhibit 99 1

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

Timing The Market Vs Time In The Market Getmoneyrich

Exhibit 99 1